What Makes the Service Supply Chain Truly Unique

What keeps management and executive leadership up at night?

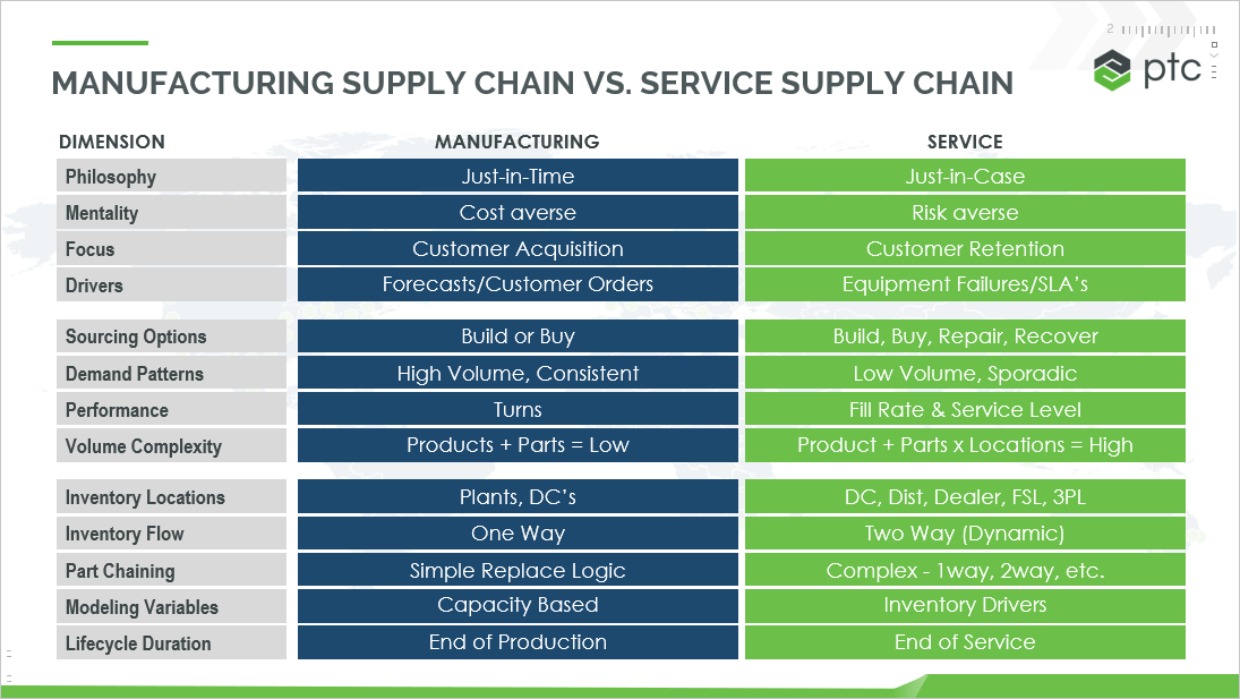

Major disruptions like COVID-19 ensure that the supply chain sits near the top of the list. But which supply chain? Most think of supply chains in a retail or manufacturing context. However, there are various types of supply chains each with unique characteristics and challenges. The service supply chain handles the supply of service parts, materials, people, and services required for efficient service delivery that maximizes equipment utilization and asset uptime. Let's take a look at a comparison of the manufacturing supply chain with the service supply chain to reveal an array of critical differences.

Manufacturing Supply Chain vs. Service Supply Chain

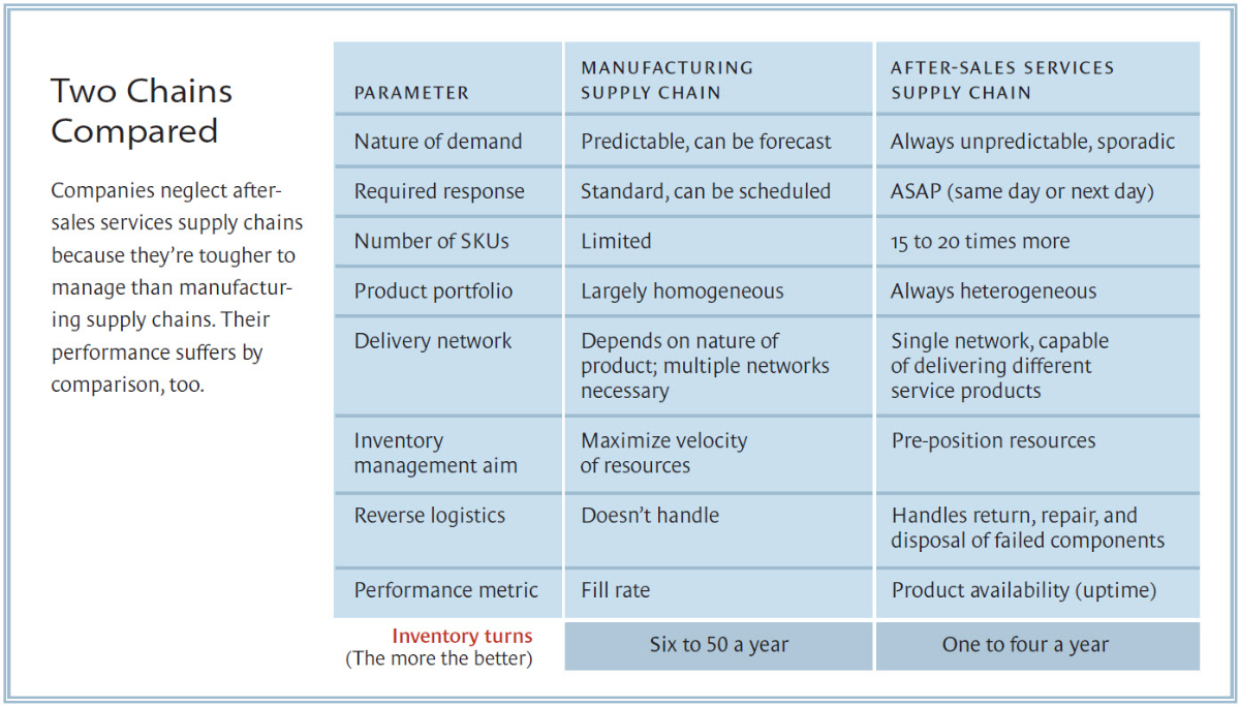

Dr. Morris Cohen, Dr. Narendra Agrawal, and Dr. Vipul Agrawal published thought leadership in the Harvard Business Review article, Winning in the Aftermarket, still relevant today. This insightful and enduring perspective continues to guide managers and OEM leadership in the 2020s.

On a number of dimensions, the service supply chain is much more complex than a manufacturing supply chain. To deliver service, OEMs must “deploy parts, people, and equipment” and do so efficiently and profitably at more locations than are required to make the products. The service supply chain must efficiently support “all the products and models a company has sold in the past, as well as those it currently makes while preparing for future products.” Each product version or generation has a different bill of materials, many with configuration variations, making the service network “cope with exponentially more SKUs” than in a manufacturing network. The nature of the service network is inherently unpredictable and inconsistent “because demands for repairs crop up unexpectedly and sporadically.”

More still, these organizations have sustainability goals to manage the incredibly complex reverse logistics loop of “the return, repair, and disposal of failed components.” A challenge manufacturing does not face. What is the outcome if this is not managed properly? “Companies face mismatches between supply and demand, deliver poor service to customers, and leave profits on the table.”

Source: Harvard Business Review, Winning in the Aftermarket, https://hbr.org/2006/05/winning-in-the-aftermarket

Research and real-world experience confirm that most organizations take the wrong path to solve these challenges. “[Most businesses] blindly apply enterprise-resource-planning thinking, processes, and software solutions to tackle the complexity of support networks.”

Complexity Creates Opportunity

The complexity of the service supply chain necessitates highly specialized, sophisticated software and advanced data science to solve the problem. More generic tools lead to more generic results.

Value leaks are introduced without a strategy to deal with the critical differences in a service supply chain. Forecast error is too high because dealing with probabilistic demand is quite different from managing pricing and promotions. Stocking levels create overlapping layers of inventory because manufacturing does not deal with integrated echelons of inventory. Excess also creeps in from ineffective management of repairable parts where the repair vs. buy processes operate independently and create another overlap in inventory. Contractual Service Level Agreements (SLAs) are beginning to dominate in service delivery. Failing to meet them can have stiff penalties while overstocking to ensure achievement erodes profits. Deploying tools that are not designed to manage the service supply chain ensures sub-optimized results from the start. Enterprises that go down this path will fail to extract the full value potential of the service supply chain. A best-in-class supply chain strategy should optimize the thousands of parts at numerous locations within the service parts supply chain to meet service goals at the lowest possible cost.

Servigistics has decades of proven capabilities to optimize the service parts supply chain using advanced multi-echelon optimization algorithms, advanced data science, and high-order math.

Mitigating Supply Chain Disruptions

Accenture reported on the supply chain impact due to COVID-19: “Business leaders must make rapid decisions, and take immediate actions to sustain business operations to serve their customers…”

Further confirmed by these metrics:

- 94% of Fortune 1000 companies are seeing supply chain disruptions from COVID-19.

- 75% of companies have had negative or strongly negative impacts on their businesses.

- 55% of companies plan to downgrade their growth outlooks (or have already done so).

OEMs supporting mission-critical equipment, operating performance-based logistics contracts, or selling advanced service models know the importance of making the best planning decisions. They have skin in the game, too.

Planning for a service supply chain during highly uncertain times requires purpose-built capabilities. Solutions without these capabilities are quickly exposed during disruptions. There are many critical inputs to the planning process whose values may be dramatically changed during supply chain disruption. The failure to efficiently model these inputs and incorporate new values into the planning algorithms prohibits the ability to develop an appropriate response.

Forecasting

Forecasts based upon service parts demand history are rarely reliable, only in the handful of high volume parts. Trying to use demand history in highly uncertain times may be pure folly because if the products you service are affected by something like COVID-19, demand history will lose its relevance and distort the forecast. Breaking the reliance on history requires a forecasting platform to leverage forward-looking data to represent the disrupted state. This can take the form of installed base metrics or forecast profiles scaled to different levels of impact of the disruption. While the complexity may persist, the ability to evaluate different demand profiles can yield valuable sensitivity analysis and the ability to rapidly react to the appropriate profile as actual data is captured.

Lead Time and Lead Time Variability

Stock levels are heavily influenced by lead times and their variability. And there are multiple lead times to be considered, such as production time, transit time, warehouse cycle time, etc. One of the first observed impacts of COVID-19 on supply chains was in lead times. As there were fewer available workers, supply lead times grew. There were fewer drivers and warehouse staff, so the lead times continued to grow. Longer lead times require higher safety stock levels to achieve the same service level. Increased variability in the lead times compounds the problem. The ability to easily evaluate alternate lead time values for thousands of parts is fundamental to respond to disruptions.

Reduced Supply Capacity

Not all parts have the same criticality to maintaining equipment up-time. In an ideal world, we would want to supply all of the parts. When parts suppliers do not have the resources to supply all parts, modeling criticality, and constrained availability helps identify which parts to prioritize for a supplier. It’s vital since the supplier may only supply a subset of the ideal roster of parts.

Budgets

Companies impacted by COVID-19 have seen dramatic changes to product sales, some with much lower sales and others with steep growth. Product sales drive economic considerations through an enterprise. This can force changes to available budgets for parts inventories. If budgets are reduced, it is important to identify which parts can reduce their stock levels with the least negative impact on service levels. Conversely, if additional budget is available, we need to prioritize which parts would most contribute to maintaining service levels.

The right tools deliver better forecasts and optimized stock levels, enabling organizations to meet service goals profitably. Modeling extensions to those tools yields critical analysis of supply chain disruption impacts while increasing the quality and responsiveness of revised material plans. Optimizing the service supply chain offers immense potential for both the service supplier and its customer by lowering the cost to deliver high service levels, maximizing customer satisfaction, revenue, and profit generation, and strengthening brand equity and loyalty.

Recognizing the difference between types of supply chains and acknowledging that the right tools are needed is the key to unlocking this value potential.